How 9x digitalised Forward Finance KYC process

125+

KYC data points handled

100%

compliant with Financial regulations

1500

hours saved per year

125+

KYC data points handled

100%

compliant with Financial regulations

1500

hours saved per year

Anthony Rivares

Managing Director, Groupe Forward

9x built a custom tool that fits our organisation's complexity

9x helped us redesign our KYC process. The team understood our complex issues and responded with great commitment and technical expertise. The tools deployed enable us to digitalize our customer relations while covering the regulatory needs specific to our asset management activity.

About Groupe Forward

Groupe Forward is an investment advisor based in Paris, France. One of its brand, Forward Finance, has been specializing in investment advice for institutional clients for over two decades.

The group has decided to digitalize its CRM and automate the filling and renewal of clients’ Know Your Customer (KYC) forms. It currently represents over 3000 form submission each year for a 12-people team at Groupe Forward.

Challenges

Groupe Forward approached us with two challenges: to streamline their KYC process and to integrate it with their operations system. We needed to devise a solution that would harness the power of automation and digitalization, eliminating the need for in-person meetings.

A time-consuming process

The KYC process is a mandatory step before onboarding any customer. It is a time-consuming and tedious process that:

requires collecting up to 125 data points per form

needs to be updated each year

is done either online but often in-person

Being able to digitalize this process would free up time for the advisor to focus on more strategic topics and enhance the client experience while reducing the onboarding duration.

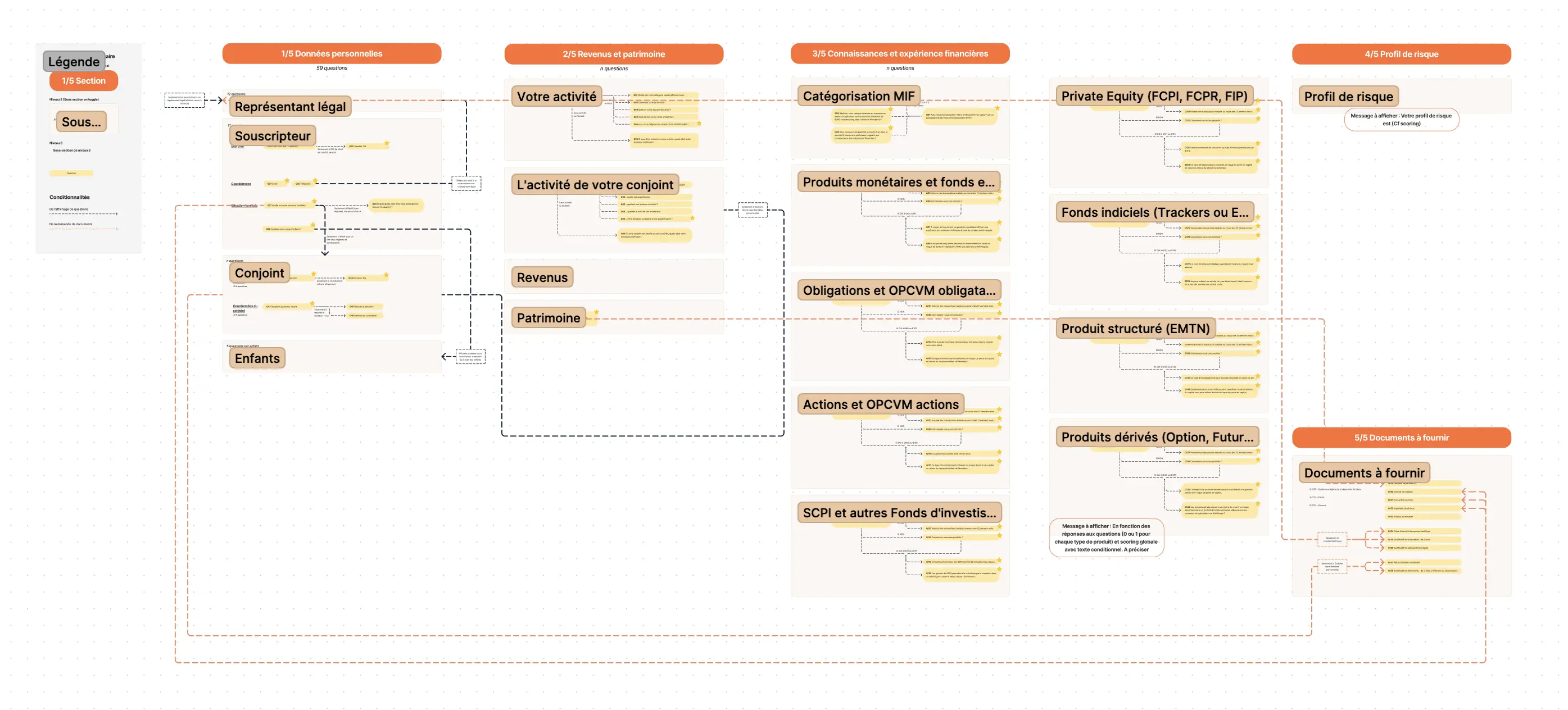

Complex information architecture

A KYC might require information from multiple individuals (the client, but also their legal representative, signatory, partner or children). The original paper version of this process required to display to each customer all 125 questions, instead of asking only for the questions relevant for the customer’s actual situation.

Security and regulatory constraints

Groupe Forward encounters a set of challenges intrinsic to their industry. Operating within the realm of sensitive personal and financial data, paramount importance is placed on compliance with European and national regulations governing data protection, transparency and fight against fiscal fraud.

Moreover, the solution had to balance the need for seamless automation with the necessity to restrict access to sensitive information and signature functions within and outside of the organisation.

A diverse customer base

The diversity of the company’s customer base called for a digital solution that can handle a large variety of situations: non digital-ready customers, legal guardians and representants, appointed administrative assistant (without signature rights), politically exposed personalities, etc.

Our solution

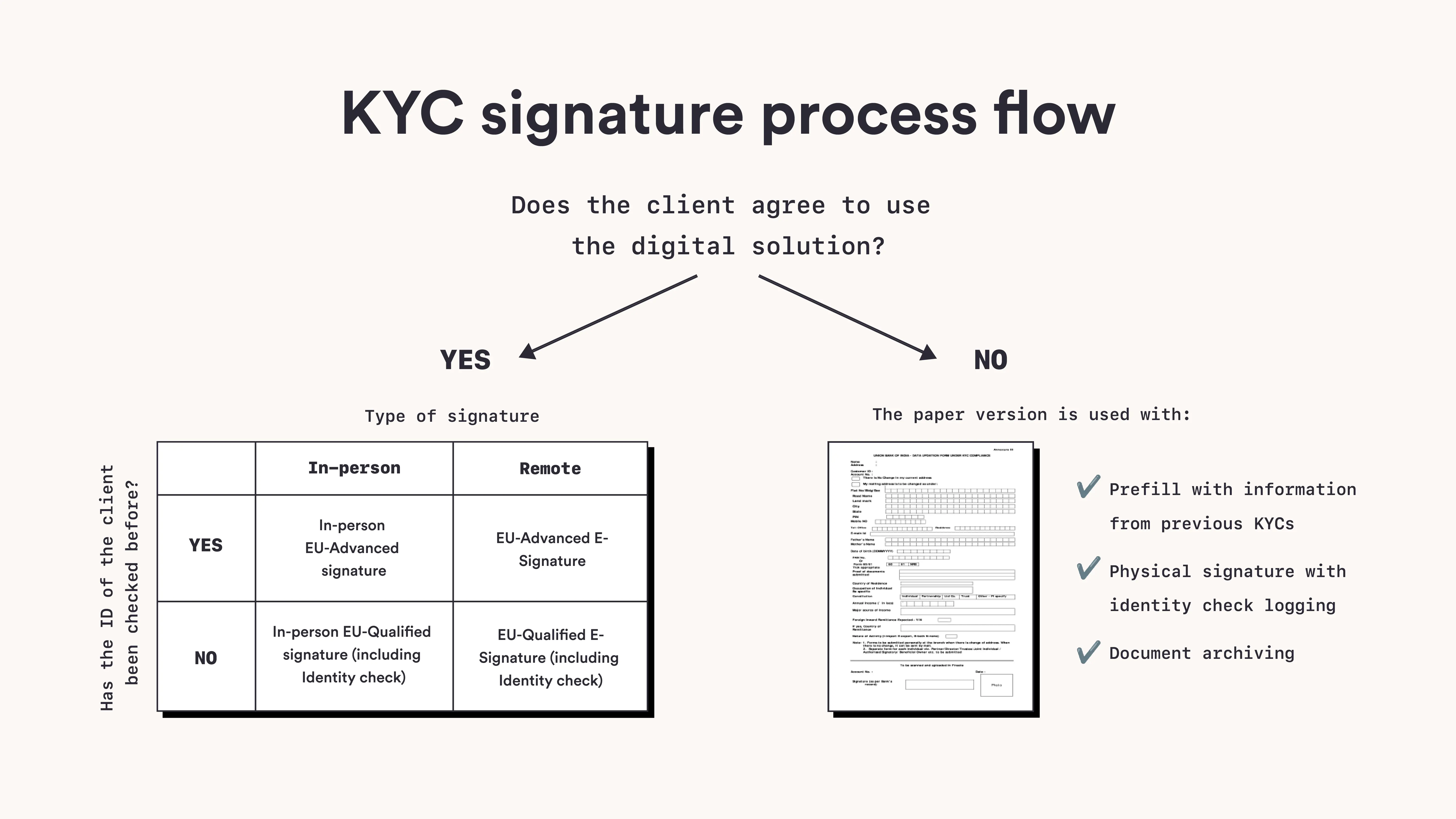

Leveraging the customisability and infrastructure from Bubble, we developed an intuitive application tailored precisely to Groupe Forward's needs. Designed with data security in mind, the app serves as a conduit, effortlessly transferring client information to the newly-forged system on Airtable. For enhanced efficiency, we introduced the robust Docusign signature and ID verification process, rendering the KYC process entirely digital.

Our collaborative approach to navigate complexity

Collaboration was at the heart of our strategy. We collaborated closely with Groupe Forward to meticulously outline existing workflows, accommodating intricacies, permissions, and a multitude of scenarios.

We lent our expertise in selecting tools, such as researching and integrating the ideal e-signature solution, to enhance the overall process.

A tailored application for a streamlined KYC process

We designed and created a dynamic KYC questionnaire. It seamlessly captures client information, replacing the need for traditional in-person exchanges.

The app boasts an intuitive interface that guides clients through the KYC journey with ease, only displaying the questions relevant to their specific situation and allowing them to upload the necessary attachments.

Clients, signatories and advisors each have their dedicated interface with the corresponding permission sets.

A deep integration with the company’s internal system

To ensure a streamlined and enhanced user experience, the KYC solution is deeply integrated with the company’s internal system.

The solution offers the possibility for advisors to prefill the form based on previous KYC submissions and current system data while allowing for manual edits.

A single click within Groupe Forward's internal system triggers an email invitation to the KYC, showcasing how technology can be harnessed to simplify even the most intricate of processes.

A comprehensive and compliant signature process

Due to the variety of its customer base, Groupe Forward needed to be able to handle 5 different signature workflows. This was key to ensure a complete and auditable compliance with AMF and ACPR regulations (French financial markets’ and institutions’ regulatory bodies).

Outcomes

Improved efficiency

the manual, time-intensive KYC process has been streamlined into a simple button press within the CRM, saving valuable time for advisors.Clients convenience

clients have gained the flexibility to complete KYC procedures at their convenience, whether at home or during busy schedules, enhancing overall satisfaction.Enhanced data architecture

client information is now fed into the operation system, automation minimizes human error in data entry, leading to higher data accuracy.Scalability

the scalable nature of the solution allows Groupe Forward to cater to a growing client base without proportional increases in administrative overhead.

How 9x supported Heylama’s successful app launch with a modern CRM solution

9x implemented a modern CRM stack for Heylama's Go-To-Market efforts. Enabling the capture and management of leads from multiple sources and user journeys.

How 9x streamlined CFA Lab’s recruiting processes from application to matching

Combining automation services, training of internal teams and co-building, 9x made CFA Lab's processes significantly faster without having to increase the size of the team